Individual Bonds vs. Bond Funds: What’s the Difference?

Individual bonds and bond funds can both provide an income stream, but there are important differences. An individual bond can offer more certainty and stability than a fund, while a fund can offer diversification that might be difficult to obtain with individual bonds.

Coupon, maturity, and yield

An individual bond has a coupon rate — the annual interest rate paid on the face value of the bond — and a maturity date, which is the date the principal is returned to the borrower. If you hold a bond to maturity, you will receive any interest payments due during the time you own it (typically paid quarterly or semi-annually) and the full principal at maturity, unless the bond issuer defaults. If you sell the bond on the secondary market before maturity, you will receive the market price, which may be higher or lower than the face value or the amount you paid, depending on market conditions.

By contrast, a bond fund does not have a coupon rate or a maturity date (with the exception of certain defined-maturity funds). A fund typically pays monthly distributions based on the bonds in the fund. The rate can change as bonds are replaced (due to maturity or sales), and as market conditions change. A fund also has fees and expenses, which reduce the interest paid, and fund managers can adjust to market conditions in various ways, depending on the fund’s objective. Because there is no maturity date, you can hold the fund as long as the fund company remains in business. However, there is never a guarantee that you will receive your principal no matter how long you hold the shares. Fund shares, when sold, may be worth more or less than your original investment.

Yield is the expected return from a bond or bond fund, based on the interest rate and purchase price. If you buy a $1,000 bond at face value with a coupon rate of 4%, the yield is 4%. But if you buy the same bond on the secondary market for $800, the yield is 5%, because you receive interest based on the face value: 4% x $1,000 face value = $40 interest / $800 purchase price = 5% yield. Bond fund yields are more complex, but the 30-day SEC yield (or standardized yield) offers a helpful comparison. This is typically calculated using the maximum share price on the last day of the month and projects annual net investment income assuming it remains the same as the previous 30 days.

Varied Performance

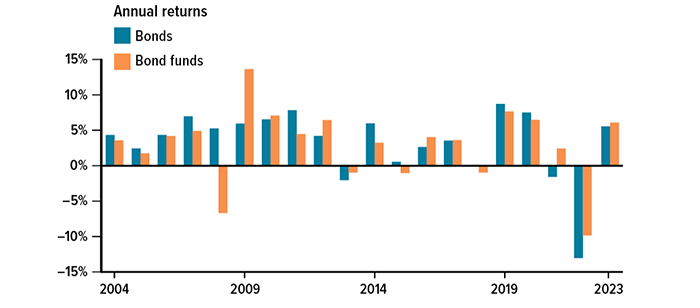

Individual bonds and bond funds have performed differently over the past 20 years. In part, this is because fund managers may respond to the market in different ways; for example, they might try to preserve yield over share price or vice versa. Note that the performance of individual bonds only applies to values on the secondary market, not to bonds held to maturity.

Source: London Stock Exchange Group, 2024, for the period 12/31/2003 to 12/31/2023. Bonds are represented by the Bloomberg U.S. Aggregate Bond TR Index, and bond funds are represented by the Thomson US: All Gen Bond - MF Index. Expenses, fees, charges, and taxes are not considered. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in an index. Rates of return will vary over time, particularly for long-term investments. Investments seeking higher rates of return involve a higher degree of risk. Past performance is no guarantee of future results. Actual results will vary.

Interest rate sensitivity

Bonds and bond funds are sensitive to changes in interest rates. Generally, when rates rise, the market value of existing bonds and bond funds falls, because newly issued bonds pay higher interest rates. Conversely, when rates fall, the market value of existing bonds and bond funds rises. This only applies to market values and would not affect an individual bond held to maturity.

If you owned bond funds during the period that the Federal Reserve was aggressively raising interest rates, you may have been frustrated as you watched the value of your shares drop. Now that interest rates seem to have stabilized, share values are likely to stabilize as well, and they may increase if rates begin to decrease. Bond funds typically replace underlying bonds as they mature, and new bonds added to funds over the last two years will generally pay higher interest rates, increasing the interest paid by the fund. Although it is impossible to predict future market direction, bond funds may be poised to offer solid returns if rates remain stable or begin to fall.

Diversification does not guarantee a profit or protect against investment loss. Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.